Contract prefill optimization

Role: Senior UX Designer, MotoRefi

Additional Talent: Product: Amal Abukar; Engineering: Jamie Swogger, Dave Craine; Subject Matter Expert: Dillon Bradley

How might we reduce friction in the contracting process?

Our contact center at MotoRefi noticed that contracting was one of the most frustrating and confusing parts of the refinance process for our customers. Lender contracts are generated near the very end of the process, after the customer has already provided their supporting documents (pay stubs, photos of driver’s license, insurance information, etc.), and many customers needed Loan Officer assistance to fill out the contracts correctly.

Customers were frustrated when they received blank fields in their contract asking for information they already provided through their documentation. Loan Officers were frustrated when customers mistakenly filled out parts of the contract on their own, such as writing “self-employed” in an employer name section rather than the name of their own company. And customers and Loan Officers alike were frustrated when contracts had to be regenerated and re-signed to correct mistakes.

Our research began by pairing with subject matter experts to do a full audit of every field across all lender contracts to determine which fields were currently prefilling data automatically, which fields could be found in supporting customer documentation, and which fields needed the customer to provide additional information not found in their application. We had Loan Officers rank, from highest to lowest, their degree of “pain” in tracking down information by category (i.e. employment/income, insurance, address/identification, etc.).

We reviewed workflows for the two main users that would be interacting with contracts in-house: Loan Officers helping the customers to track down their documents and information, and Funding Specialists reviewing document packages and cross checking contracts in QA. We also found that most of the fields were already editable within the CRM, but were scattered across the interface and it wasn’t efficient to edit multiple items at a time. Additionally, some of these fields were not programmed to prefill the contracts.

Our solution:

- Collect as much information up front and prefill the contracts before the customer signs; ideally, all a customer would need to do is review and add their signature.

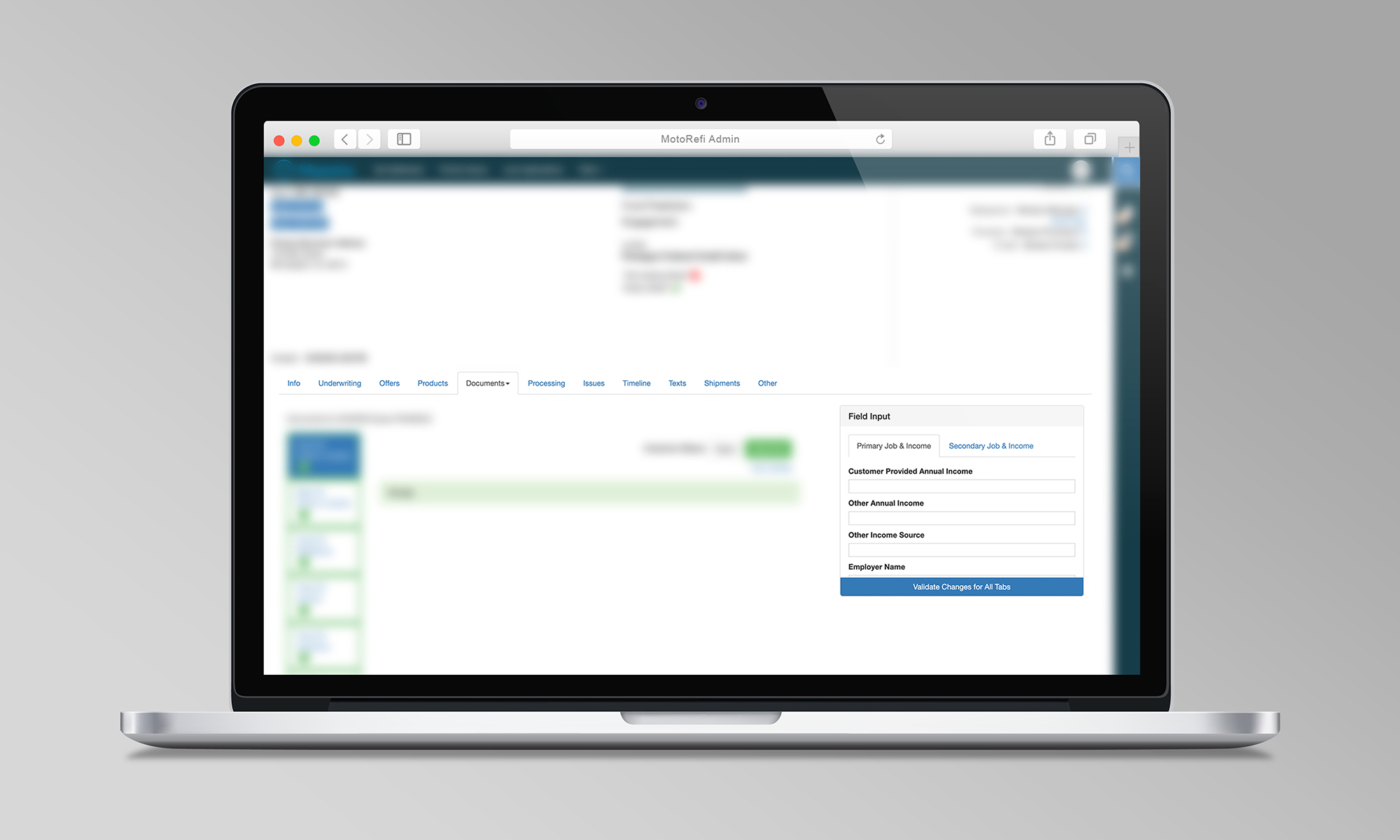

- Create a persistent window for entering information in the documents tab of the CRM, because much of the information would come from documents the customer sends in.

- Make this window available even if there are no documents attached to the loan yet, so a Loan Officer could still capture information they gather in conversations with the customer.

- Use this opportunity to do a database check-up and make sure the customer data is correctly appearing/updating in all places in the CRM, and make sure that existing data is configured to prefill contracts.

- Validate data upon saving for required fields that rely on other fields, such as employment start date paired with employment end date.

- Create an alert message for the user if they attempt to edit fields or add fields after a contract has already been generated; this allows the user to make a judgment call if the contract needs to be regenerated.

We began working with a small subset of available fields that Loan Officers had identified as highest-pain-point: employment and income. Our MVP aimed to deliver maximum value for our users and the business while we built out additional functionality; our plan was to iteratively add insurance information followed by personal/identification information as fast-follow items.

Engineering put the early prototype up onto our demo CRM environment to test our solution with a select group of Loan Officers and Funders. With their feedback, we made adjustments and launched our MVP.

Key metrics for success for the feature include:

- percent of people using the feature in the CRM;

- reduced number of re-contracts over previous levels, which indicates a reduction in errors by both Loan Offers and customers;

- reduced time it takes customers to sign and return contracts; and

- percent of total fill-able fields completed before contracts are generated.

The feature was recently launched, and we have just begun collecting data to measure these metrics.